A recent model-based routing platform OpenRouter An analytical report on data revealing the changing landscape of the Big Model API market in the first half of 2024.OpenRouter As a platform that aggregates all kinds of model APIs, its usage data provides a unique window into the true preferences of developers and the application layer for different AI models. The data shows that the market is moving from chaos to differentiation, and the strategic division of several giants is becoming clearer.

Stagnant growth goes hand in hand with an active long tail

The data shows that the total number of model APIs Token After experiencing an explosive growth of nearly four times in the first quarter of 2024, the call volume entered a plateau period, stabilizing at the level of about 2 trillion Token per week, with no further significant scale expansion. This may mean that under the current technology and application scenarios, the first wave of dividends of the API market has basically been digested.

However, the stability of the total volume hides the internal turbulence. Outside of the headline models, the total usage of "other models" has stabilized at a significant share (~600-700B Token/week), forming an active "long tail". This indicates that the market demand is highly diversified, developers are actively looking for and testing the most suitable models for specific tasks, not the most famous ones, and the competition in the market segments is still fierce.

In the popular model, theGoogle 的 Gemini 1.5 Flash It tops the usage charts with competitive pricing (only $0.4 per million output Token), a large contextual window, and excellent speed. Its high-level version Gemini 1.5 Pro It was a close second, showing strong growth.

In contrast, the once-challenged Anthropic Instead, it appears to have a weak backbone.Claude 3.5 Sonnet has largely completed its iteration of the old version, but its overall usage has not continued to grow, but has entered a steady state.

it's worth noting that... OpenAI performance. Its models, including the highly regarded GPT-4o mini, has been extremely inconsistent on the list, with dramatic fluctuations in usage and no model consistently stabilizing in the top ten in terms of usage. This is in stark contrast to its strong brand presence in the consumer market.

Market Share: Google's Victory and OpenAI's Myths

The distribution of market shares further confirms these trends.Google Topping the list with an overwhelming 43.1%, its comprehensive matrix of models (from high-performance Pro to cost-effective Flash) is effectively encroaching on the Anthropic of the market space.

From China DeepSeek It has emerged as the second largest with 19.6% share, even surpassing the Anthropic(18.4%). Since DeepSeek-V2 Since its release, it has demonstrated a very high level of user stickiness, proving that its product power is highly recognized in specific user segments (such as the role-playing segment mentioned below).

OpenAI of market share ranked only fourth and with a significant gap to the top three. This raises a central question:OpenAI Is it true that it doesn't value the pure API market? Its strategic focus seems to be more in favor of ChatGPT This mega-app and its enterprise solutions, while being relatively conservative in developer-facing API pricing and availability (e.g., application thresholds for new model API access), have lost some ground in the price-sensitive and convenience-seeking developer market.

Meanwhile, the once highly anticipated Meta Llama series, its market share has shrunk to one-fifth of its peak. This may indicate that the hidden costs of deployment and maintenance of open source models in the face of convenient, low-cost commercial APIs puts them at a disadvantage in direct competition with the giants.

Segmenting the battlefield: the trend towards specialization is prominent

When we look at specific application areas, the "each on its own" phenomenon in the market becomes particularly evident. This is a sign that, in addition to AGI, specialized models optimized for specific scenarios have found a clear path to commercialization.

- Programming Field:

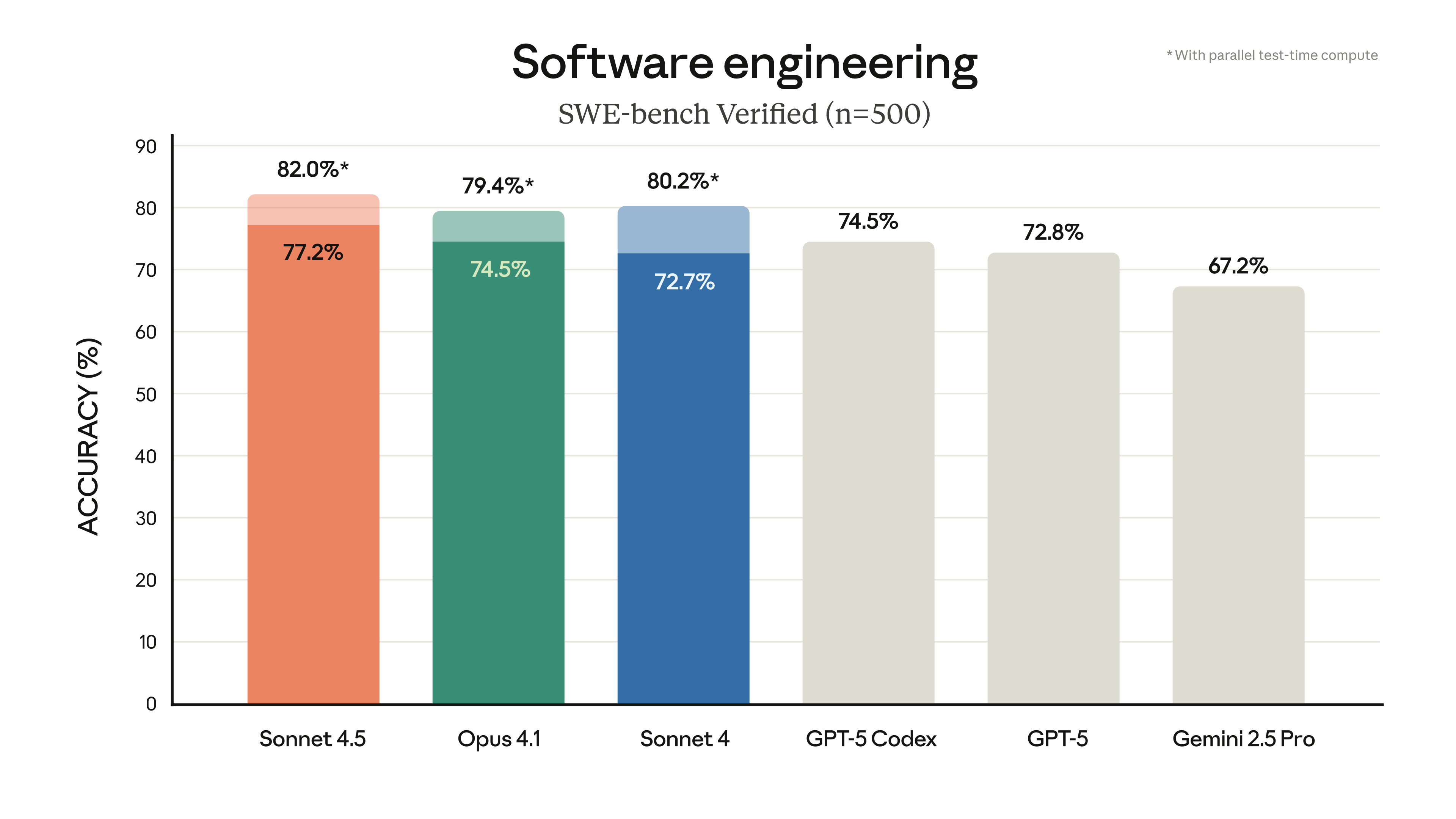

Anthropic的Claude 3.5 Sonnetis the absolute king with 44.5% share. This shows thatAnthropicFocused its R&D resources effectively on specialized tasks such as code generation and understanding, and successfully built technical barriers.Google的Gemini 1.5 ProSecond in this field.

Figure Note: Model Calls in Programming Domain

- text translation:

GoogleDemonstrating its traditional strengths in the field.Gemini 1.5 FlashIt was the top choice for its cost-effectiveness. It's worth noting that the vast majority of the top dosages areGooglemodel, which may suggest that many translation-based applications have incorporated theGooglemodel as the default or preferred backend service.

Figure Note: Model calls in the translation domain

- Character Chat: This is a highly fragmented market, with niche models collectively accounting for 26.6%.

DeepSeekThe fact that it excels in this area may be related to the "more imaginative" or "more hallucinatory" nature of the model, which fulfills the need for creativity and imprecision in this scenario.

Figure Note: Model calls in the role-playing domain

- marketing copywriter:

OpenAI的GPT-4ooccupies an absolute leadership position of 32.5% in this field. This reflectsOpenAI's model remains the industry benchmark for training results and user preference on mass-oriented, non-technical creative and text generation tasks.

Figure Note: Model Call Volume in the Marketing Domain

API Interface: Code Tool Driver Usage

In terms of API interface (client-side) usage, code aids are the largest source of traffic. Of the top four interfaces, theCline、RooCode 和 KiloCode All are code writing tools. This shows that in the current API application ecosystem, improving developer productivity is the most core and immediate scenario. The fifth-ranked SillyTavern It is a local large model interaction interface, and confirms the activity of role-playing and creative interaction scenarios.

This war for the big model API market is far from over, but the winners and losers of the first half are already emerging.Google With its cloud services advantage and comprehensive model matrix, it is building a platform-level moat.Anthropic 和 DeepSeek and others have found their own niche by deepening their focus in specific areas. While OpenAIThe king of the consumer market, its strategic choices in the developer market will be one of the most interesting variables to watch in the second half.