Accounting firms often face problems with segregation of client data and inefficient communication.Finlens' team collaboration features enable a leap in efficiency by..:

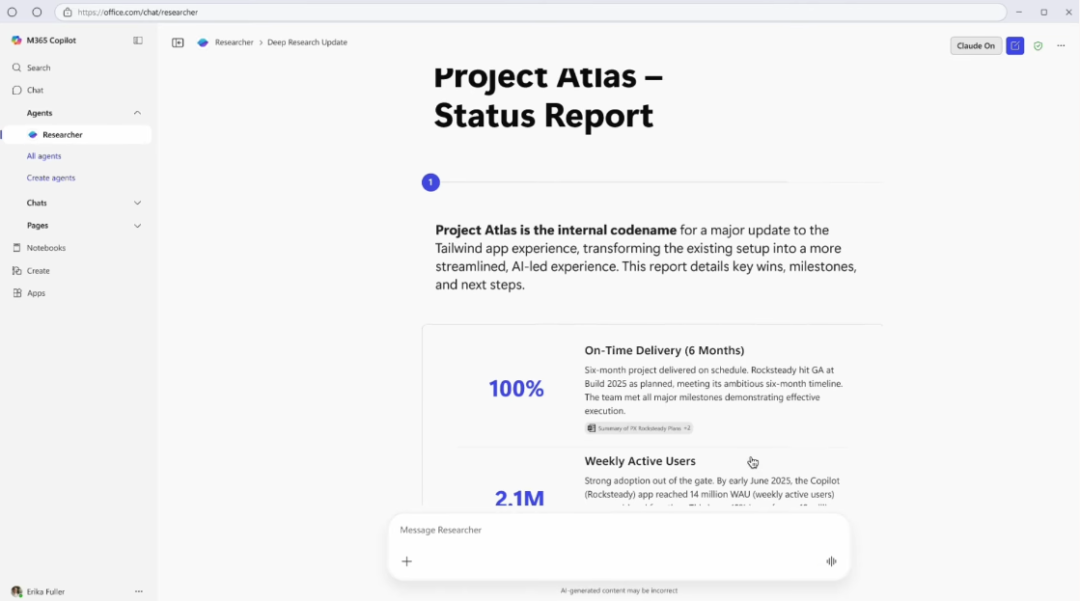

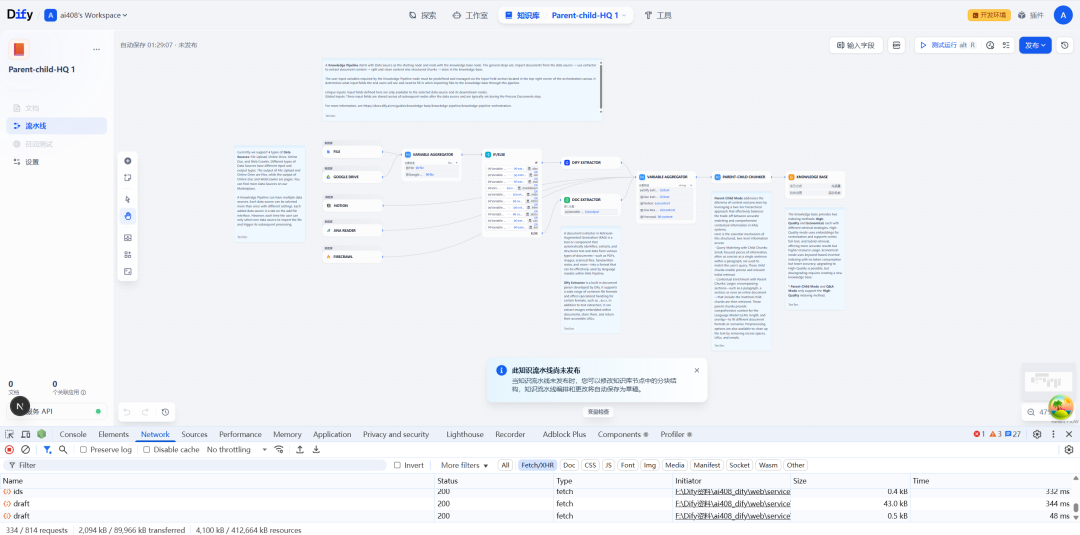

Collaborative workflow program

- hierarchical administration of competence: Fine-grained control of partners (full access), accountants (edit access), interns (read-only access)

- Centralized workbench: Separate sub-accounts for each customer, support for quick switching of views to avoid data confusion

- Online annotation system: Add query tags directly to the transaction record and the system automatically notifies the responsible person

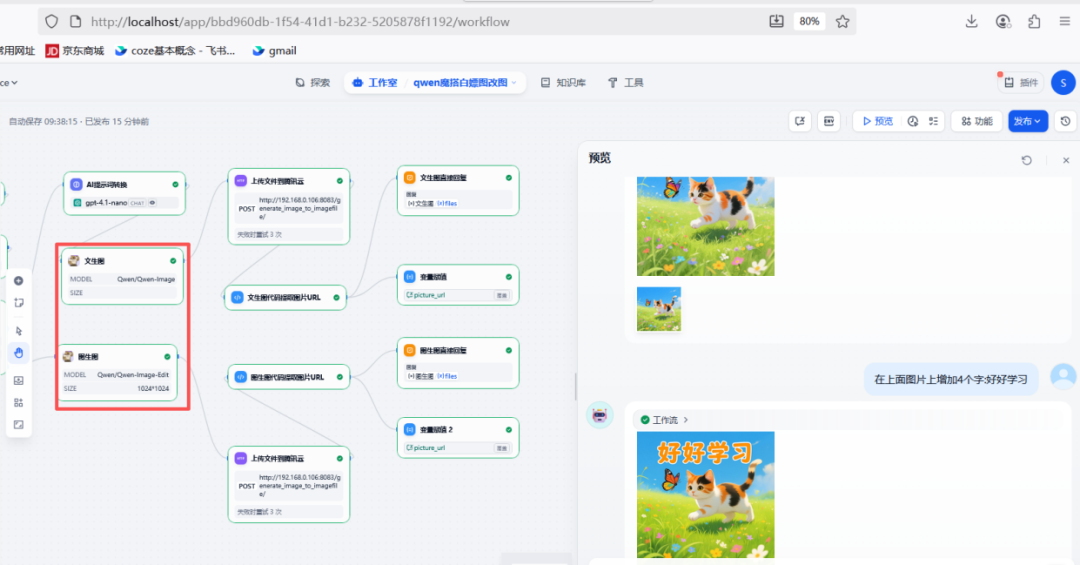

Key Functional Applications

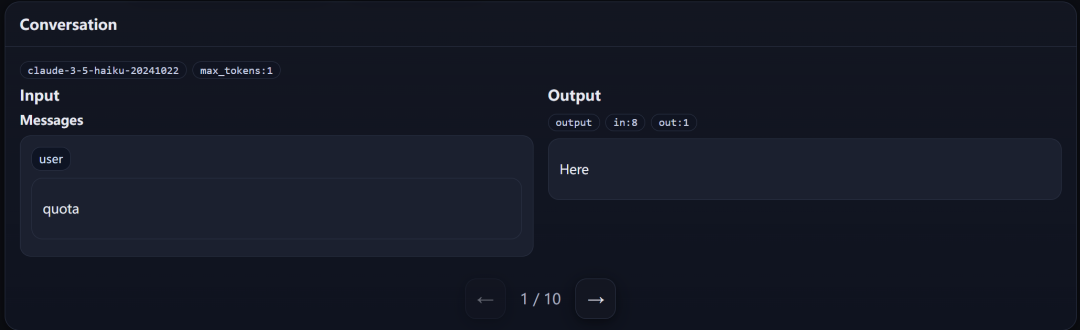

- utilizationPending Approval Transaction KanbanCentralized processing of large expenditure approvals and shortened approval cycle 60%

- opensAutomated month-end reminders:: Push to-do list to team 3 days in advance

- configureCustomer-specific templatesPredefined categorization rules for customers in different industries (e.g., restaurant vs. technology)

Actual results: After the application of a 10-member accounting firm, the processing speed of client accounts was increased by 40%, and the team's overtime time was reduced by 65%.

This answer comes from the articleFinlens: AI-powered financial automation tools for startups and accountantsThe