A nearly successful $3 billion acquisition collapses, and the founders then lead their core team to "defect" to a competitor, leaving behind a company with an instantly evaporating valuation and 250 employees. This isn't a script, it's a 2025 startup in AI programming tools. Windsurf A scene that really played out. In the end, the company was acquired by another competitor and the entire workforce was preserved. This series of events sparked a heated debate in Silicon Valley about the responsibility of founders, the value of employees, and the new acquisition model.

From OpenAI's Guest of Honor to Google's "In the Bag"

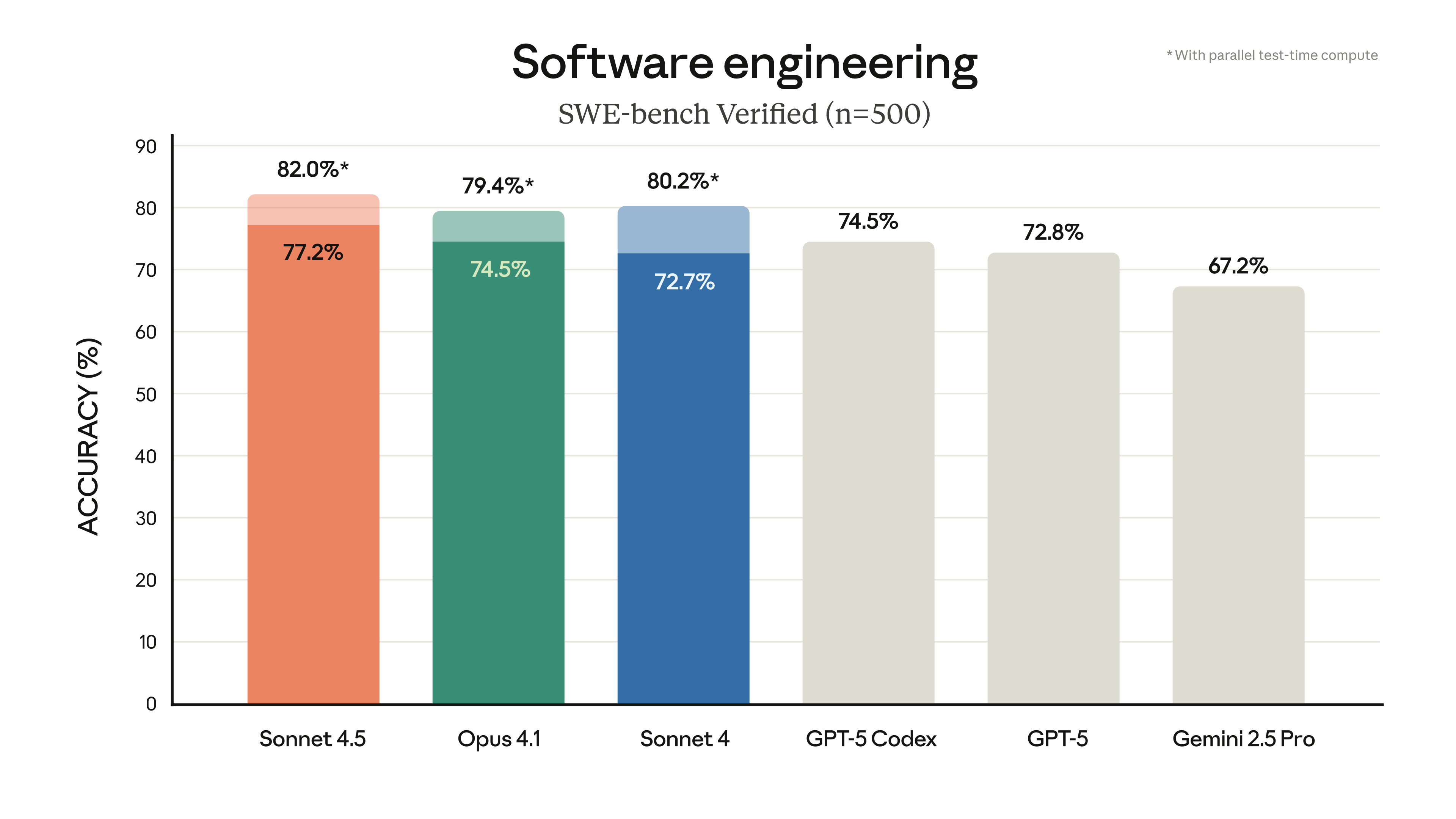

At the center of the story is AI programming assistant startup Windsurf and its founder Varun Mohan, which at one point attracted a $3 billion takeover offer from OpenAI on the strength of its billion-dollar-a-year revenue track record. However, the deal was unexpectedly halted at the last minute. The reason was rumored to be that OpenAI's main investor, Microsoft, didn't want to see Windsurf compete with its own GitHub Copilot Formation of direct competition.

After the deal fell through, Varun Mohan's choice shocked the industry. Instead of leading the company on its own, he accepted Google DeepMind's Olive Coffer and led the company's core technology team. The deal was not in the form of a company-level acquisition, but rather a package of technology licenses and high-paying jobs totaling nearly $2.4 billion.

The move reduced Windsurf itself to a virtual shell, its high valuation was instantly reduced to zero, and the future of its 250 employees was put in jeopardy.

Self-help and rebirth in 48 hours

In the midst of the chaos caused by the founder's departure, the company's director of operations, Jeff Wang, was named interim CEO, an experience he described on social media platform X as "hellish," with the company's morale crumbling and its finances in disarray.

Within 48 hours, however, a turnaround occurred when Cognition, a competitor in the AI space, quickly stepped in and announced that it was acquiring Windsurf's remaining assets, brands, and entire workforce for approximately $300 million. Cognition offered a very favorable deal, not only retaining all the jobs, but also eliminating the existing equity restrictions, giving employees a direct share in the company's future financial success. Cognition's offer was extremely favorable. This decision allowed employees who were on the verge of losing their jobs to keep them, and Windsurf was able to continue in an unexpected way.

During those 48 hours as interim CEO, I went through a hellish time. There were employees crying in meetings, the entire team was demoralized, finances were in disarray, and departures were imminent.

- Jeff Wang, Windsurf Interim CEO

"Betrayal or rationality: Silicon Valley's values rift

The incident stirred up a huge controversy in Silicon Valley VC circles.

Vinod Khosla, an early investor in OpenAI, called Varun Mohan's actions a "betrayal" and said he would never invest in a project led by him again, while Amjad Masad, founder of Replit, said he thought the actions undermined the "social contract" based on trust that has long characterized Silicon Valley. Amjad Masad, founder of Replit, also argued that such behavior undermines the "social contract" based on trust that has long characterized Silicon Valley, and the CEO of Cognition said, "A true founder chooses to live and die with his ship."

But there are dissenting voices. Garry Tan, CEO of Y Combinator, points out that Varun Mohan's decisions have resulted in seven-figure personal returns for the company's earliest 40 engineers and the preservation of $2.3 billion in assets for investors. He rhetorically asks whether society is too hard on successful founders.

The core of this debate exposes a deep rift in the values of Silicon Valley: on one side is the traditional concept that emphasizes that founders should live and die with their companies and have a moral responsibility to employees and shareholders; on the other side is absolute rationalism that seeks to maximize personal interests and asset values.

"Talent acquisition": a new type of M&A that is becoming the norm

What's even more concerning is that the Windsurf case reveals a new type of deal-making pattern that is spreading in Silicon Valley - "buy the person, not the company.

In recent years, including Character AI, Inflection in a number of well-known AI companies in a similar situation: large technology companies (such as Google, Microsoft, NVIDIA) use strong capital, directly high salaries to hire the founders of the target company and the core technology team, at the same time to obtain their intellectual property rights in the form of technology licensing.

For acquirers, this model circumvents the lengthy process and rigorous antitrust scrutiny faced by traditional corporate mergers and acquisitions, and is a faster, cheaper way to acquire top talent and cutting-edge technology. As venture capitalist Steve Brotman puts it, this model is faster and cheaper.

However, the cost of this trend is heavy. It crudely reduces the value of a company to a handful of core people and technologies, while placing the contributions and future of the vast majority of ordinary employees in great uncertainty. For startup employees who are paid lower salaries and rely on equity incentives to dedicate themselves to the company, this is tantamount to a betrayal. When the bedrock of trust is shaken, Silicon Valley's entrepreneurial culture and innovation ecosystem, on which its success depends, may also face unprecedented challenges.