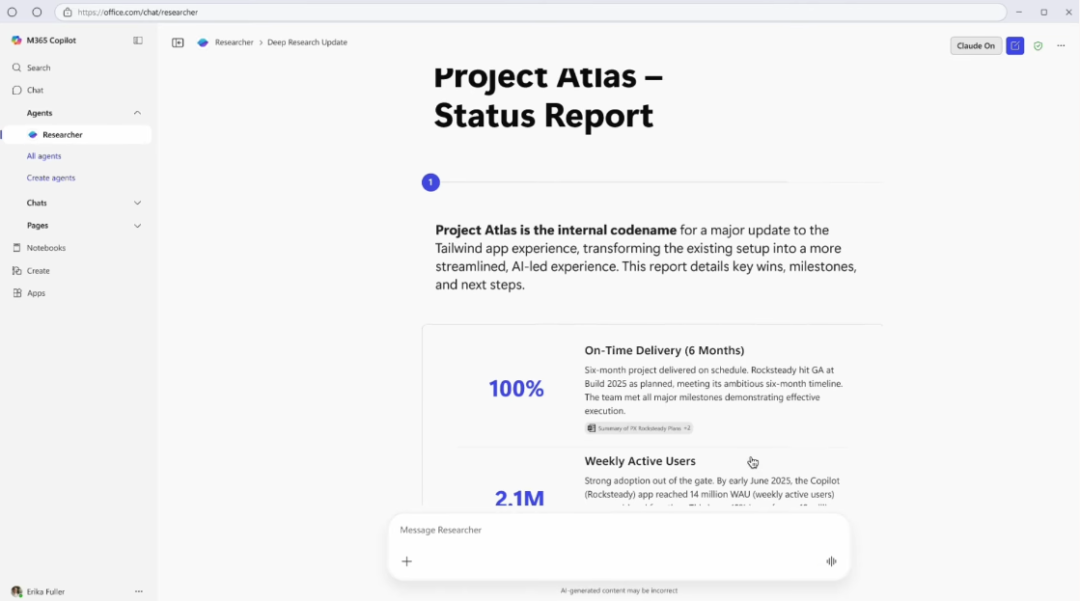

Founders often spend a lot of time manually creating investor reports. finlens' AI reporting system automates this in three steps:

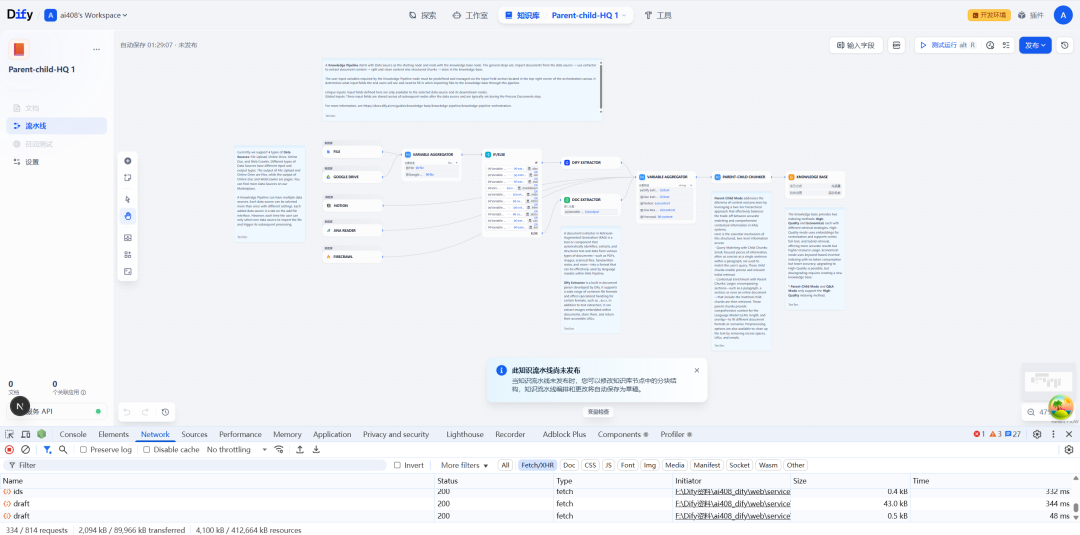

Implementation pathway

- Data Source Integration: Connects to bank accounts, QuickBooks and Stripe to automatically capture raw data

- Intelligent Template Configuration: Selection of VC preference templates (e.g. Burning Rate analysis, CAC/LTV modeling)

- Dynamic visualization: Set the frequency (daily/weekly/monthly) of automatic refreshing of key indicators (MRR, ARR)

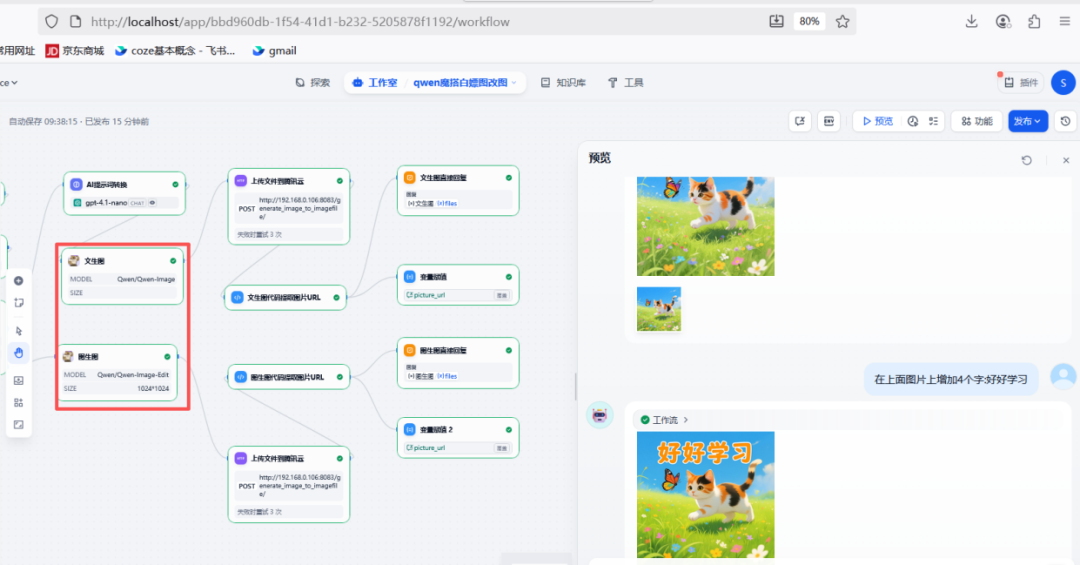

advanced technique

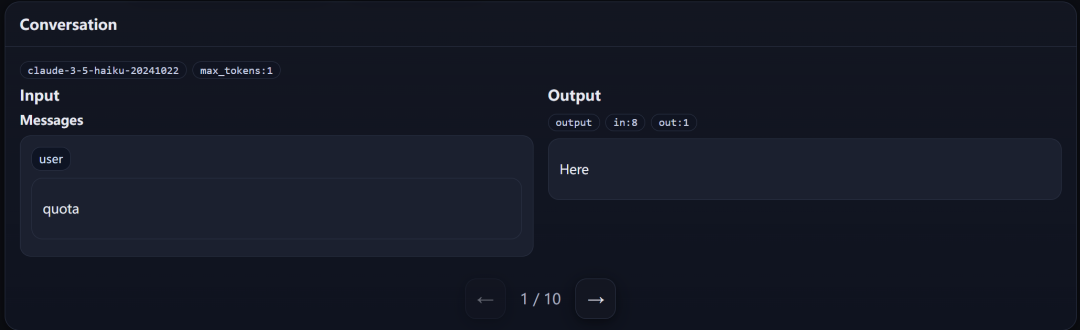

- utilizationcomparative analysisFunction: Automatically generate this month vs. last month/competitor benchmark data

- activationEarly warning of unusual fluctuations: Trigger alerts when key indicators deviate from predicted values by more than 151 TP3T

- establishReporting timeline: Systematic recording of successive versions of the report to facilitate retrospection of key decision points

Success Story: With this feature, a Series A company reduced the preparation time for investor meetings from 20 hours to 2 hours, and received particularly favorable feedback from investors on its financial transparency.

This answer comes from the articleFinlens: AI-powered financial automation tools for startups and accountantsThe