Startups often suffer from misclassification of transactions, unclear cash flows, and other financial disruptions due to founders moonlighting in finance or lack of dedicated accountants.Finlens provides a systematic solution through the following AI-driven features:

Core solution steps

- Automated data integration: After connecting bank accounts, the platform automatically synchronizes all transaction data to avoid manual entry errors

- AI Intelligence Classification: The system recognizes common transaction types above 90% (e.g., office supplies, travel expenses) and learns from users to manually correct their records to enhance accuracy

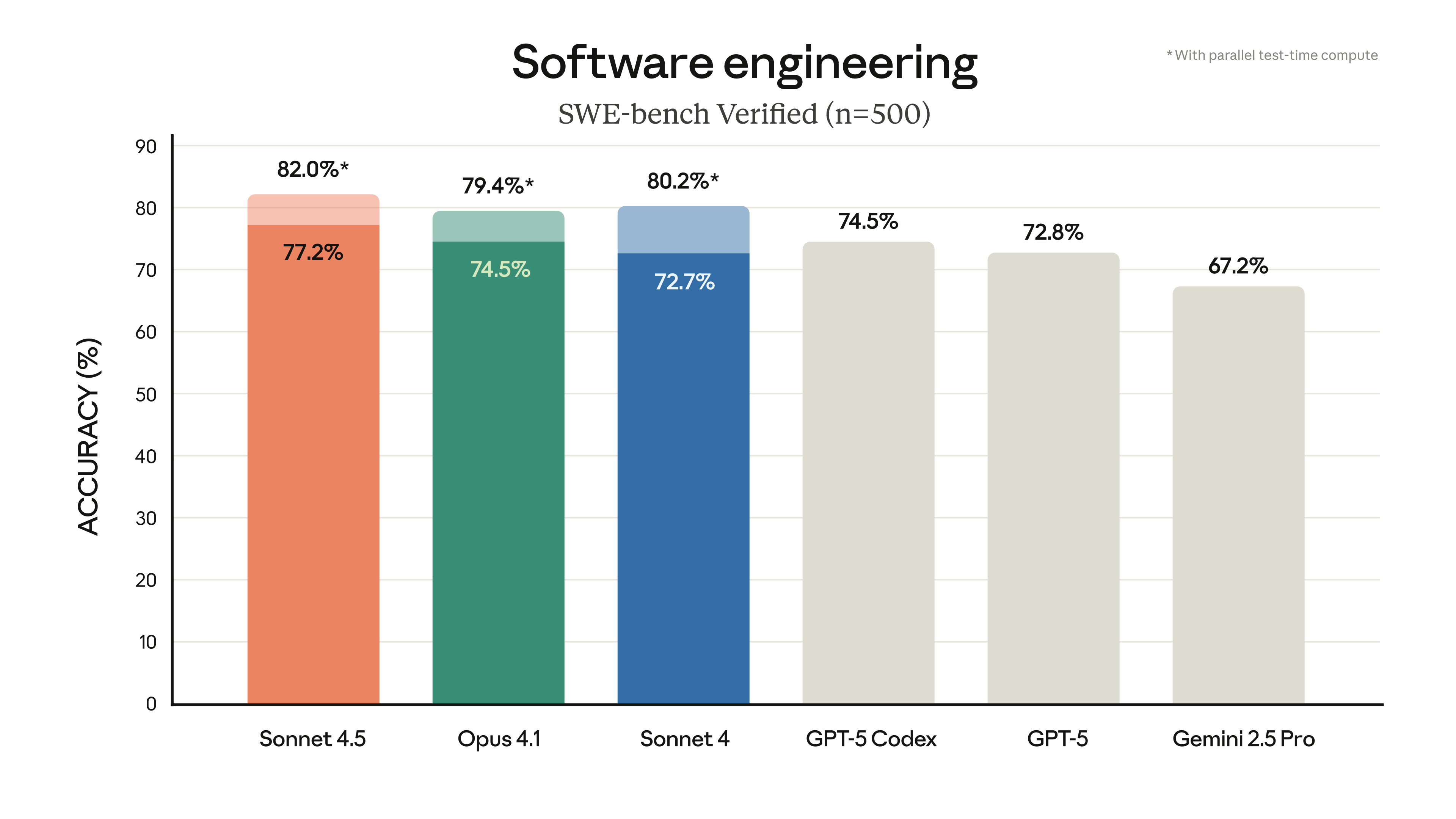

- Real-time DashboardVisualized charts and graphs instantly show key indicators such as cash flow and income/expense ratios, allowing founders to keep track of their finances.

Advance Operation Recommendations

- utilizationbatch fileFunctions monthly centralized review of AI classification results, 3 times more efficient than single-article processing

- set upCustomized rules: Fixed classification labels for special transactions (e.g. offshore payments)

- Periodic exportGAAP standardized statementsMeet compliance auditing needs

Typical use case: After a SaaS startup used it, the monthly reconciliation time was shortened from 8 hours to 30 minutes, and the financial error rate dropped by 76%.

This answer comes from the articleFinlens: AI-powered financial automation tools for startups and accountantsThe