ContestTrade Functional Structure

The framework contains several key functional modules that together form a complete AI trading decision system:

- Automated Stock Screening: The system automatically scans the entire A-share market and generates a list of potential investment candidates.

- Event-driven analysis engine: Focus on analysis of news announcements, capital flows, industry policies and other market-catalyzing events

- Smart Body Configuration System: Allows users to customize the trading beliefs and investment style of the research intelligences

- Two-stage decision-making process::

- Data processing stage: processing raw data and refining valid factors

- Research decision phase: in-depth analysis and final portfolio formation based on data factors

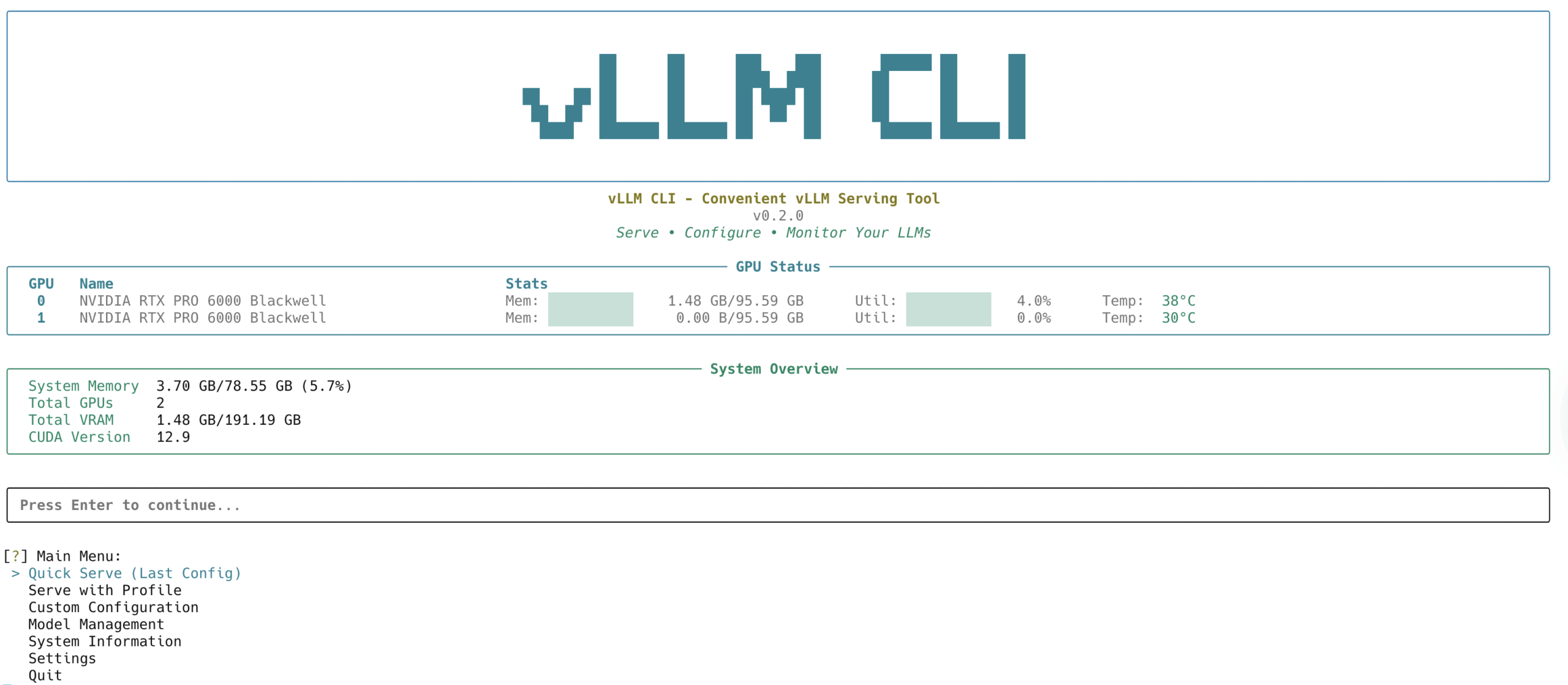

- Command Line Interactive Interface: Provide easy-to-use terminal operation

Featured Functions

Of particular interest is its personalized intelligence body configuration function, the user can modify the configuration file to customize each research intelligence body's trading beliefs (Trading Beliefs), so that the AI's behavior is more in line with a specific investment style and risk appetite. This design allows the system to be used for both standardized analysis and personalized investment needs.

This answer comes from the articleContestTrade: an AI multi-intelligence trading framework for event-driven investingThe